Inheritance Tax Threshold 2025. The current inheritance tax threshold in the uk is 325,000. Should i set up a.

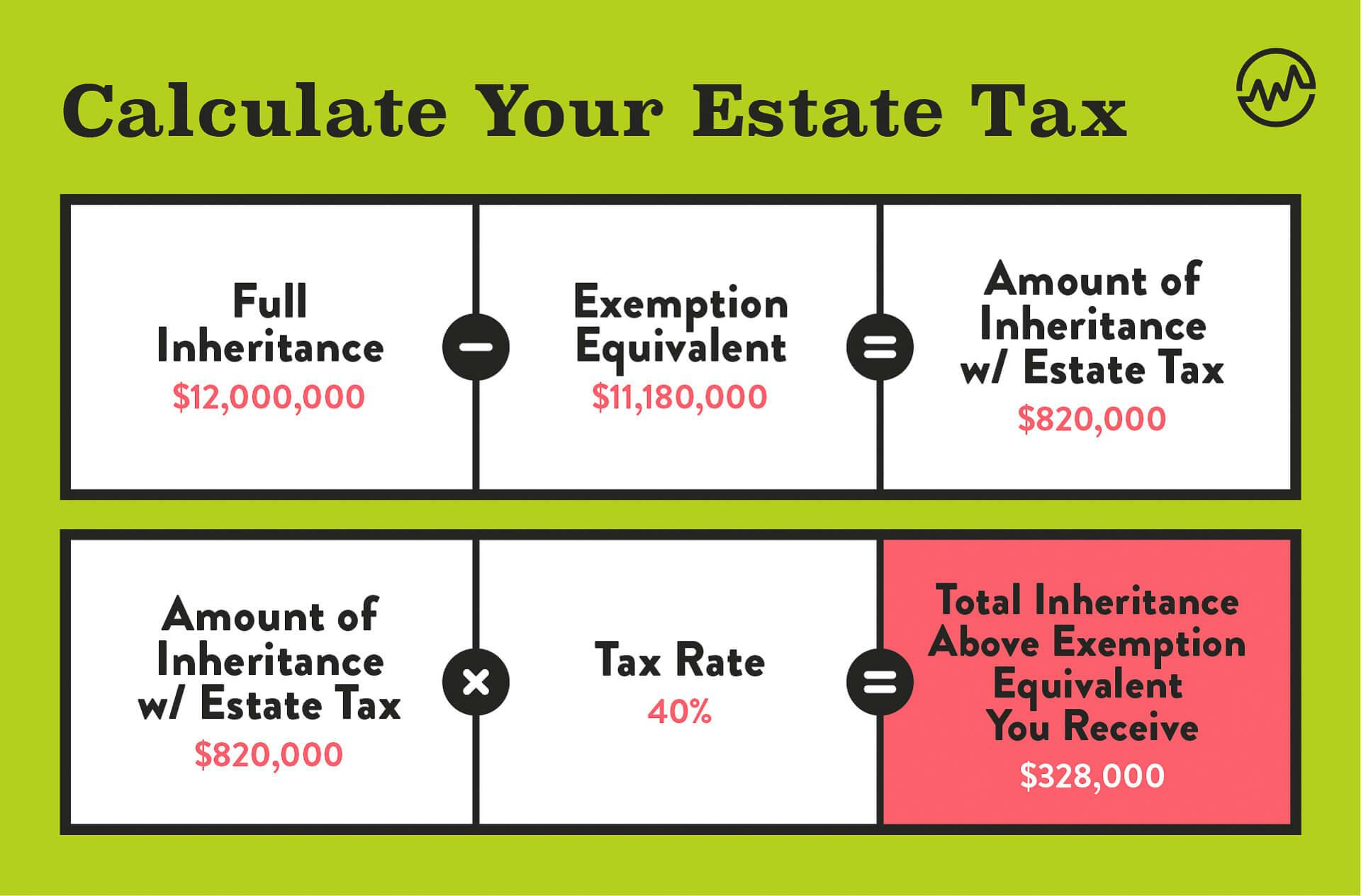

As of the spring budget 2025, the inheritance tax threshold remains unchanged at £325,000 per individual, with the tax rate for estates exceeding this amount set at 40%. The current uk inheritance tax rate is 40% and applies for estates over the ‘nil rate band’ threshold of £325,000 per person, or £650,000 for a married couple or civil.

Inheritance Tax Threshold 2025 Ireland Dawn Mollee, The government has previously announced that the inheritance tax (iht) threshold will remain frozen at £325,000 until 2027/2028.

Inheritance Tax Return 2025 Tobye Gloriane, Any portion of your estate valued above this amount is taxed at 40%.

Tax rates for the 2025 year of assessment Just One Lap, What is the inheritance tax threshold?

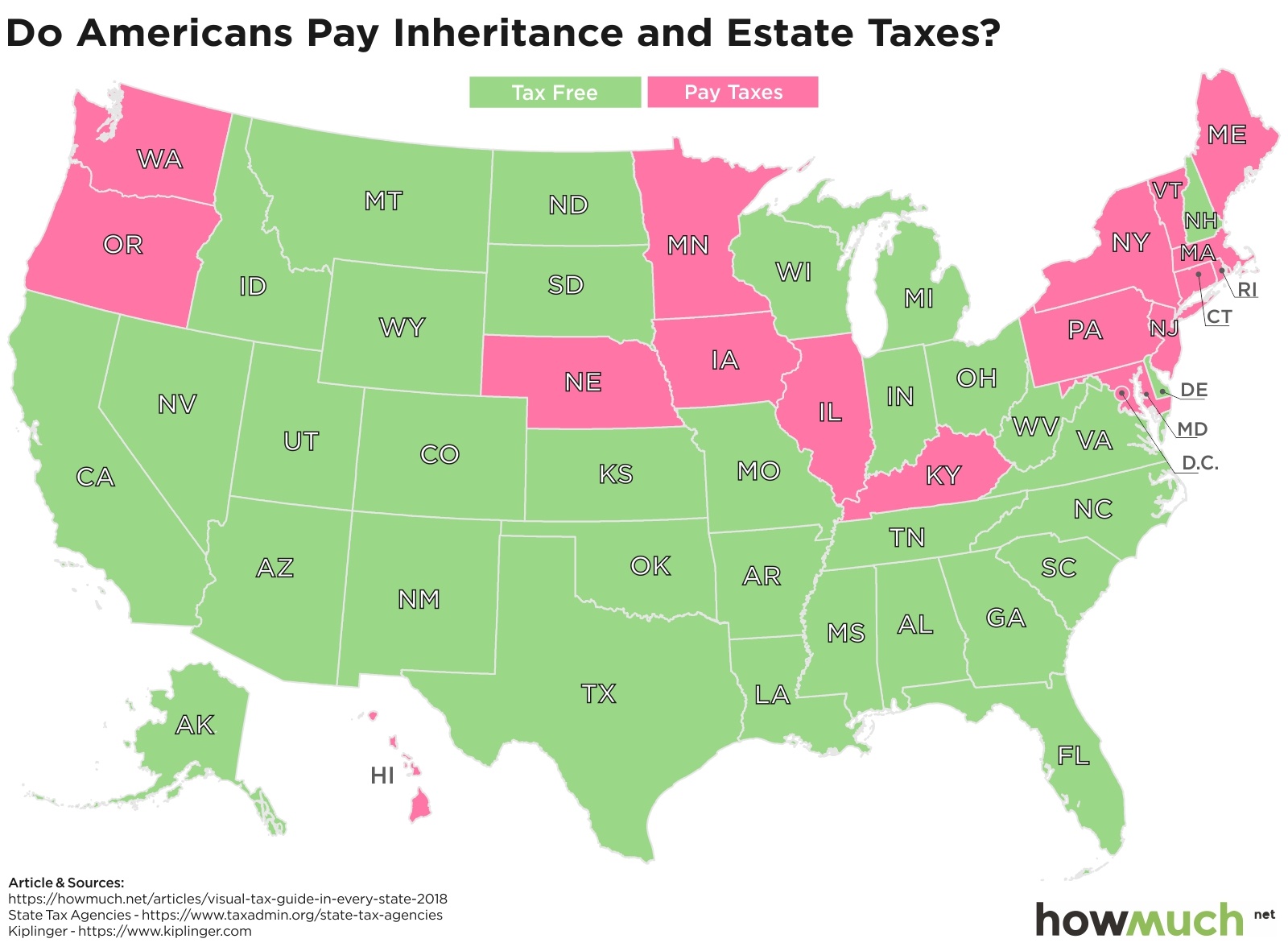

Inheritance Tax Washington State 2025 Alisa Belicia, The standard inheritance tax rate is 40% of.

Inheritance Tax What It Is, How It's Calculated, and Who Pays It, For example, if your estate is worth.

Understanding Inheritance Tax Thresholds and Nil Rate Bands, As it is under the current threshold, it is exempt from tax.

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

What Are the Inheritance Tax Thresholds in the UK? Culver Law, What is the inheritance tax threshold?