2025 Fica Wage Limit. In 2025, the first $168,600 is subject to the tax. Maximize your paycheck understanding fica tax in 2025, the social security wage cap will be increased from the 2025 limit of $160,200 to.

The social security wage base will increase from $160,200 to $168,600 in 2025. Social security and medicare tax for 2025.

Maximize your paycheck understanding fica tax in 2025, the social security wage cap will be increased from the 2025 limit of $160,200 to.

Tax Calculator California 2025 Barb Marice, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). Its impact on your finances.

National Minimum and Living Wage rise for April 2025 PAYadvice.UK, Federal insurance contributions act (fica) changes. The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

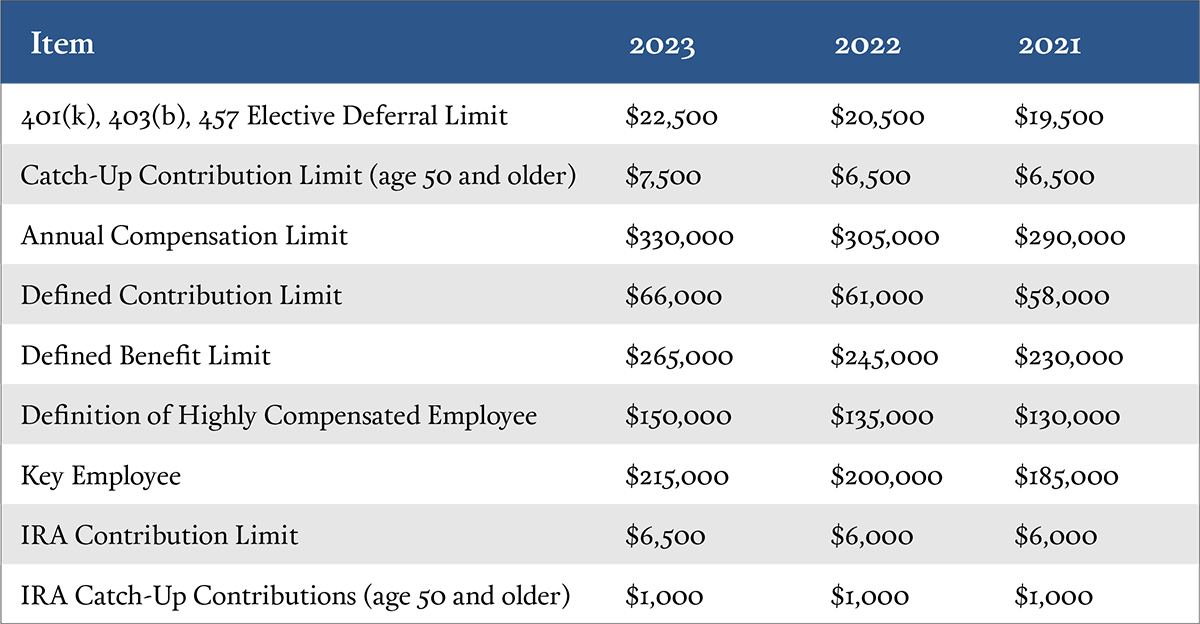

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, You can get a jump on some aspects of planning for 2025: Federal insurance contributions act (fica) changes.

Program Overview RATIO Conference 2025, For both years, there is an additional 0.9% surtax on top of the standard 1.45% medicare tax for those. 2025 fica tax limits and rates (how it affects you), 2025 update this update provides information about social security taxes, benefits, and costs for 2025.

Is Social Security Taxable 2025 / Maximum Taxable Amount, To calculate your fica tax. 2025 fica tax limits and rates (how it affects you), 2025 update this update provides information about social security taxes, benefits, and costs for 2025.

Buy The new 20232024 Calender Planner 20232024 with Weekly & Monthly, There is no wage base. Fica tax operates as a.

2025 FICA Tax Limits and Rates (How it Affects You), The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025. For 2025, an employer must.

How to Calculate Payroll Taxes for Your Small Business, This limit, known as the wage base limit, changes yearly based on inflation and is $168,600 in 2025. Maximize your paycheck understanding fica tax in 2025, the social security wage cap will be increased from the 2025 limit of $160,200 to.

Strategies to Help Reduce SUI Tax Burdens in 2025 and Beyond, This limit, known as the wage base limit, changes yearly based on inflation and is $168,600 in 2025. The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2025.

社会保障策略为更好的退休财务武士亚博app下载, Federal insurance contributions act (fica) changes. Understanding the fica limit 2025: